Do you Co-own a rental property? If so, your borrowing power for your next home may have just increased dramatically. A long read here, but it explains a policy change that has recently happened, and how it impacts anyone who co-owns investment real estate.

Say Bert and Ernie own a rental property together, an up/down duplex that is rented for $3800/month and after all costs it cashflows a couple hundred dollars per month. If Bert now wants to go buy a new home for himself his lender will look at the co-owned property and they will allow him to use HALF of the rental income (1900/month) as he is half owner, but will make him cover ALL of the expenses! This means that a property that is actually cashflow positive is now heavy cashflow negative on Bert’s new application, this negative cashflow is calculated as a liability in his new application, and dramatically reduces his borrowing power.

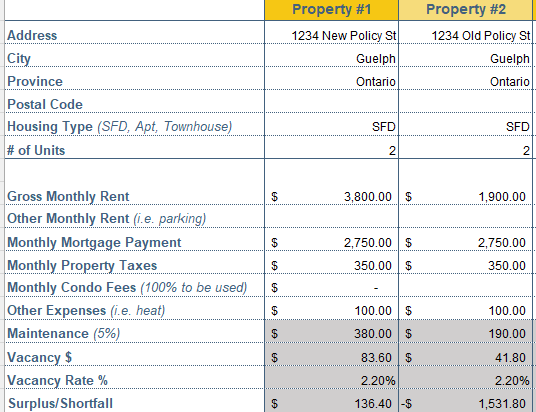

A Canadian A space monoline lender recently changed their policy for exactly this sort of situation. Rather than cutting the useable rents in half for a co-own property, they’ll allow 100% of rents used, and take half of any cashflow surplus for Bert’s new application and add it as additional income. I ran the numbers for a sample scenario just to show how much of an impact this can make. In my scenario Bert is making 125K/year salary, has clean credit, and minimal debts (outside the co-owned rental mortgage) and is putting 10% down on a new owner occupied home. In a baseline scenario where Bert doesn’t own any other real estate he would be approved for a $510,000 mortgage with today’s rates. In the co-owned rental scenario under the Lender’s new policy seen in the Property 1 column below we are able to add a $68.20/month (half of the $136.40 surplus) in additional income to the application, so now his co-owned rental is actually increasing his borrowing power to $513,500 in mortgage approval. Under the old policy (and every other lender’s current policy – seen in the Property 2 column below) we’d be cutting gross rents in half to $1900, and this would leave us with a $1,531.80/month shortfall which would be added as a debt or liability to Bert’s new application. This would reduce his mortgage approval amount to $293,000. This is a swing of $220,500 in approval amount due to this policy change!!! Just imagine if Bert and Ernie co-owned 2 or 3 rentals together. ***Please note this policy applies only to Insured or Insurable mortgages, so the new home needs to be owner occupied, and under a $1M purchase price. *** For those looking closely at the rental worksheet below, the reason the maintenance is actually showing 10% of gross rents is because it’s a 2 unit property, it is calculated at 5% of gross rents per unit. The lender with this new policy update is Strive Capital.

Have a co-owned rental and want to see what this policy change means for your borrowing power? Or have mortgage questions in general? Reach out!

Craig Van Dolder – Van Dolder Mortgages

519 372 8524

Email: craig@vandoldermortgages.com